clay county tax collector mo

Once scheduled you will receive reminders as the pending appointment time nears. When contacting Clay County about your property taxes make sure that you are contacting the correct office.

Clay County Collector Of Revenue Home Facebook

Category 2 Additional fees of up to 7 of the tax assessed billed to and paid by taxpayers for collection of delinquent taxes In most counties the fees in category 2 are imposed at the rate of 7.

. You will need either 1 the PIN from your mailed renewal notice or 2 your license plate and birthday. Clay County MO Collector and Assessors Offices. The Treasurer is responsible for receipting all County revenues making bank deposits investing County monies balancing County bank accounts banking funds held in trust by the County and tracking all county funds.

Property Account PARCEL Number Search. Clay County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Clay County Missouri. To make an appointment select a service and click Make an appointment.

If you have questions regarding the combined taxes on your bill from the County please contact the Clay County Collectors office at 816-407-3200. The fee amount will be displayed before payment is finalized. You may either call 816-407-3460 or send an email to bppassessorclaycountymogov for assistance before driving to the office.

Business Personal Property - The business dept. County tax bills including the City portion also are now available online through the Clay County Collectors Office. Starting November 1st Property Tax payments can be made without an appointment at our Green Cove and Keystone branches or by making an appointment at our Bear Run and Park Avenue branches.

For Clay residents ONLY except Concealed Weapons. Clay County collects on average 121 of a propertys assessed fair market value as property tax. ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County.

Clay County Tax Collector. CLAY COUNTY MISSOURI TAX. To make a new appointment you must acknowledge that your personal data.

816 407 - 3370 email. These records can include Clay County property tax assessments and assessment challenges appraisals and. To search for a.

816 407 - 3370 email. The format for Real Estate is 14 numeric digits. The Clay County Treasurers Office operates in accordance with the statues of the State of Missouri.

Name Clay County Tax Collectors Office Suggest Edit Address 1 Courthouse Square Liberty Missouri 64068 Phone 816-407-3200 Fax 816-407-3201. HOW TO USE THE PROPERTY TAX BILLING PORTAL. The Office of Diane Hutchings TAX COLLECTOR.

Clay County has one of the highest median property taxes in the United States and is ranked 535th of the 3143 counties in order of median property taxes. Clay County residents may schedule appointments for all services typically conducted in these branches. They may be able to answer your questions or address your concerns over the phone.

Renew your vehicle or vessel registration in Clay County FL. Credit card payments will still incur a fee of 245. The Department of Revenue is responsible for taking steps to ensure individuals and businesses pay their tax liability.

The tax maintenance fund is used to pay the expenses of the county collectors office. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Is located at the Clay County Annex and is open Monday through Friday 8am-4pm.

HOW TO USE THE PROPERTY TAX BILLING PORTAL Clay. The format for Personal Property is 14 numeric digits the first three digits are zeros. If you already have an existing appointment you can also reschedule as well as cancel it.

You can call the Clay County Tax Assessors Office for assistance at 816-407-3500. The convenience fee is not paid to Clay CountyAll payments by check and debit card Visa MasterCard and Discover debit are FREE. Clay County Tax AssessorCollector Porsha Lee Tax Assessor-Collector I would like to thank you for visiting the Tax AssessorCollectors office website.

See Sections 52250 52260 54280 and 54325 RSMo. Clay County Tax Collectors Office Contact Information Address Phone Number and Fax Number for Clay County Tax Collectors Office a Treasurer Tax Collector Office at Courthouse Square Liberty MO. These steps can range from an initial balance due notice to more serious collections enforcement actions such as liens administrative judgments garnishments asset seizures and referrals to collection.

GISMapping Assessors Office phone. What do my City property taxes fund. Our office is committed to serving the public in a friendly and efficient manner.

If you have any questions or need additional information please feel free to contact our office. Welcome to NQ appointment. The median property tax in Clay County Missouri is 1863 per year for a home worth the median value of 153900.

Silversea Shares Details On Its Return To Sailing Luxury Travel Advisor

See Where You Can Drop Off Taxes In Clay County Without Having To Get Out Of Your Car Fox 4 Kansas City Wdaf Tv News Weather Sports

Salvatore Ferragamo S Museum New Exhibit Spotlights Silk Accessories Wwd

Clay County Collector Of Revenue Home Facebook

Activists Demand Sexual Violence Against Argentina S Indigenous People Be Classified A Hate Crime Global Development The Guardian

Clay County Collector Of Revenue Home Facebook

Faq Categories Personal Property Tax Clay County Missouri Tax

Clay County Collector Of Revenue Home Facebook

Us Air Force F 15c Eagle Records Longest Known Air To Air Missile Shot The Aviationist

About Clay County Missouri Tax

Missouri Auditor Releases Reports On Municipalities And Special District Financial Information Missouri Jefferson City Missouri State

Faq S Clay County Missouri Tax

Travel Hamilton Grange World Archaeology

How To Use The Property Tax Portal Clay County Missouri Tax

Vetus Bow Pro Thruster Sail Magazine

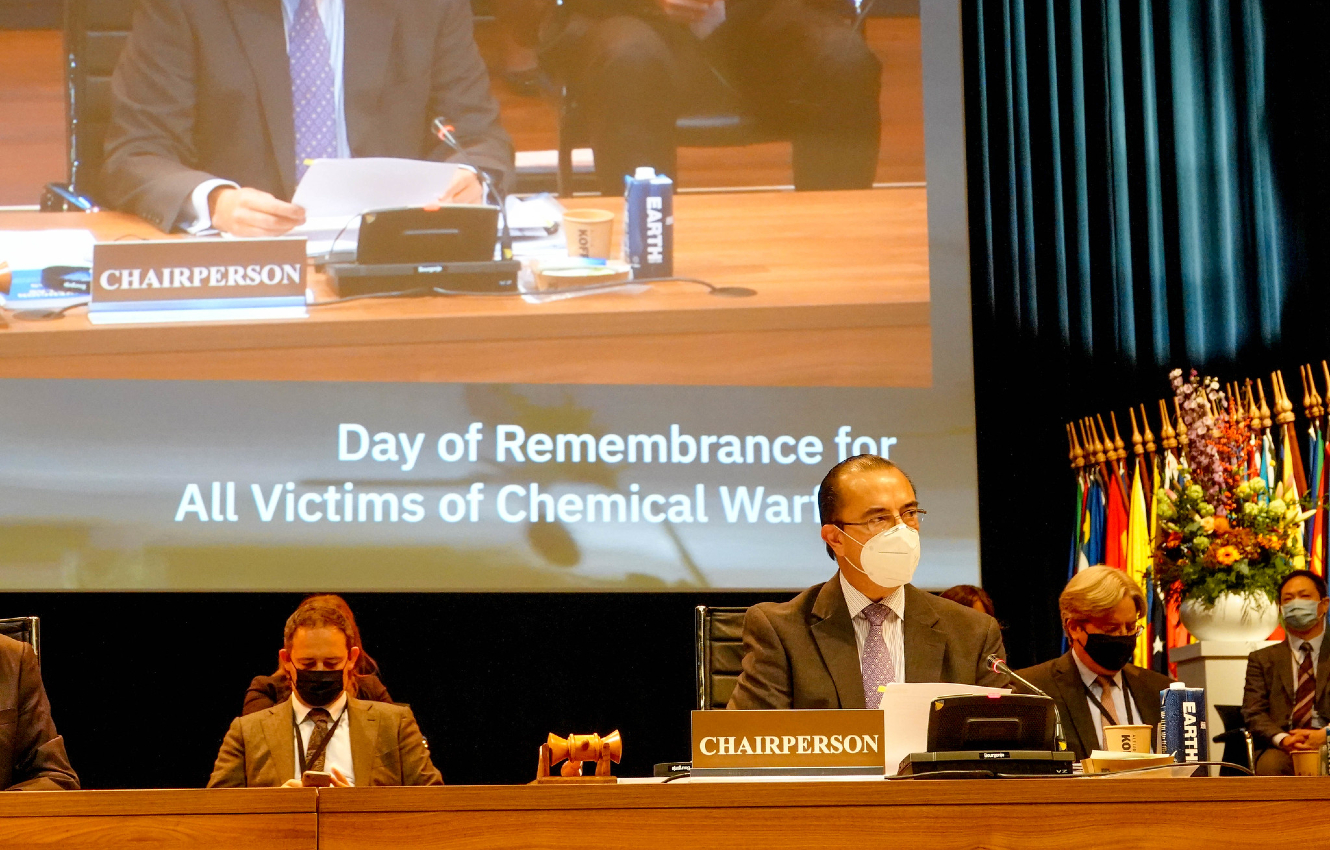

Chemical Weapons And The Hierarchy Of Victims War On The Rocks

Clay County Collector Of Revenue Home Facebook